Forex Brokers: Top-Rated Platforms for Trading Success

Forex Brokers: Top-Rated Platforms for Trading Success

Blog Article

Translating the World of Foreign Exchange Trading: Discovering the Significance of Brokers in Managing Threats and Guaranteeing Success

In the complex realm of forex trading, the function of brokers stands as a pivotal aspect that frequently continues to be shrouded in secret to lots of ambitious traders. The relevance of brokers surpasses plain transaction assistance; it reaches the realm of danger management and the general success of trading undertakings. By turning over brokers with the task of browsing the complexities of the foreign exchange market, investors can possibly unlock a realm of chances that might otherwise stay evasive. The complex dancing between brokers and investors introduces a cooperative relationship that holds the key to untangling the mysteries of rewarding trading endeavors.

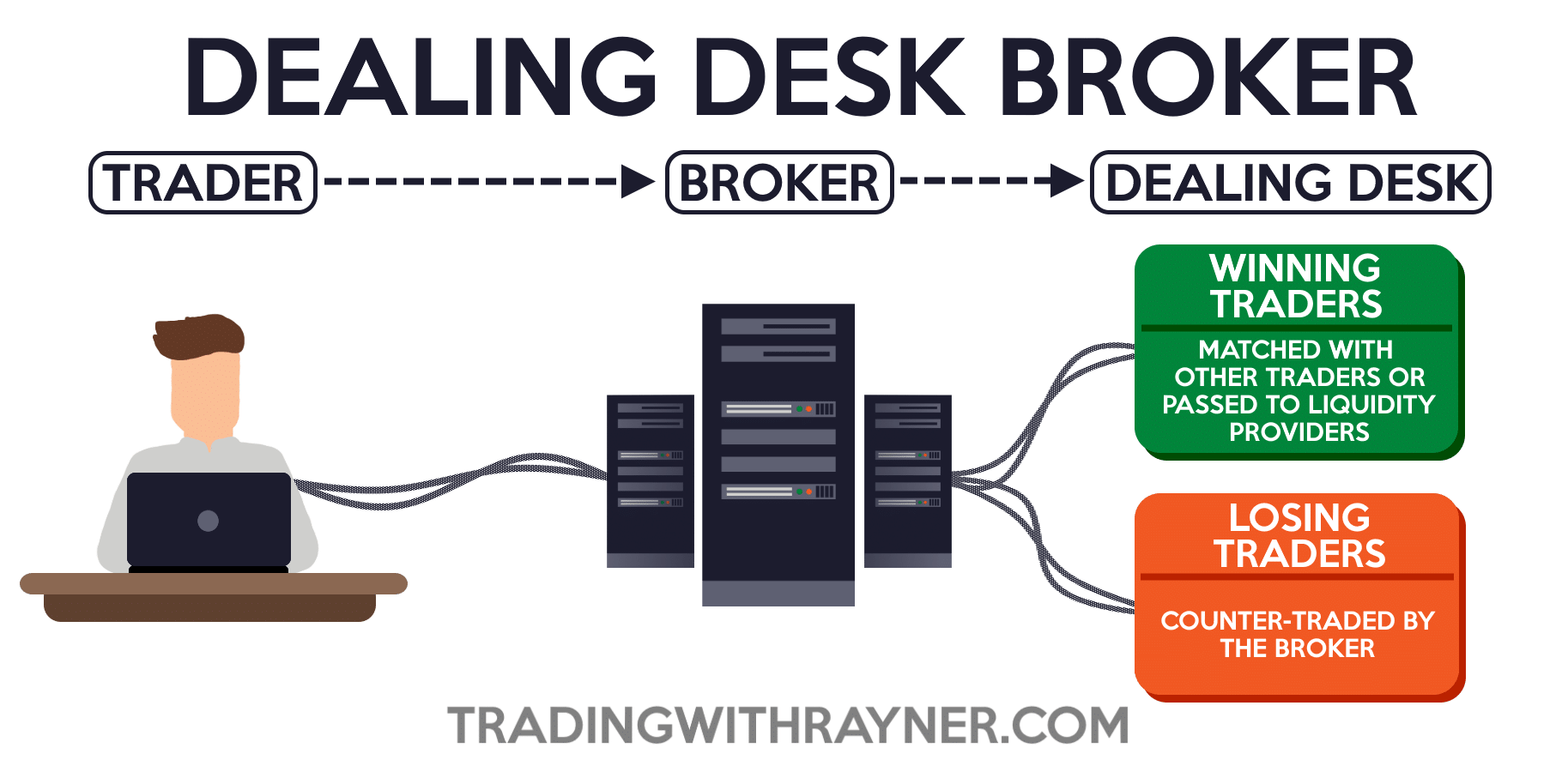

The Duty of Brokers in Foreign Exchange Trading

Brokers play an important duty in foreign exchange trading by supplying vital services that assist traders take care of threats effectively. One of the primary features of brokers is to provide investors with access to the market by helping with the implementation of professions.

Additionally, brokers provide educational sources and market evaluation to help traders make educated decisions and develop effective trading methods. Generally, brokers are essential partners for traders looking to navigate the forex market effectively and manage risks properly.

Threat Management Methods With Brokers

Given the critical role brokers play in helping with access to the fx market and providing risk management tools, understanding effective strategies for handling dangers with brokers is necessary for successful foreign exchange trading. One essential strategy is establishing stop-loss orders, which enable investors to predetermine the maximum quantity they want to shed on a trade. This tool helps limit potential losses and protects versus negative market motions. Another crucial danger management approach is diversity. By spreading out investments throughout different money sets and possession courses, investors can decrease their exposure to any kind of single market or tool. Furthermore, utilizing utilize meticulously is crucial for threat administration. While utilize amplifies earnings, it additionally magnifies losses, so it is essential to use utilize carefully and have a clear understanding of its implications. Keeping a trading journal to track performance, assess past professions, and determine patterns can aid traders fine-tune their approaches and make more educated choices, ultimately improving threat administration techniques in forex trading.

Broker Choice for Trading Success

Selecting the best broker is critical for accomplishing success in foreign exchange trading, as it can dramatically influence the general trading experience and results. Functioning with a controlled broker offers a layer of safety for investors, as it ensures that the broker operates within set criteria and standards, therefore decreasing the danger of fraud or malpractice.

In addition, traders should analyze the broker's trading system and tools. Checking out the broker's customer assistance services is essential.

In addition, traders must examine the broker's fee framework, including spreads, payments, and any concealed charges, to understand the price implications of trading with a certain broker - forex brokers. By thoroughly evaluating these aspects, investors can choose a broker that straightens with their trading goals and establishes the phase for trading success

Leveraging Broker Experience commercial

Exactly how can investors efficiently harness the experience of their chosen brokers to maximize success in foreign exchange trading? Leveraging broker competence for earnings requires a tactical technique that entails understanding and utilizing the solutions offered by the broker to improve trading end results. One key way to take advantage of broker competence is by making use of their research and evaluation devices. Several brokers provide access to market understandings, technical analysis, and economic calendars, which can assist traders make notified choices. By remaining educated concerning market fads and occasions through the broker's resources, traders can determine rewarding possibilities and minimize risks.

Additionally, investors can gain from the support and support of seasoned brokers. Developing a good connection with a broker can lead to customized guidance, profession suggestions, and danger administration approaches customized to specific trading designs and objectives. By connecting regularly with their brokers and looking for input on trading methods, traders can touch into experienced knowledge and boost their general performance in the foreign exchange market. Eventually, leveraging broker experience commercial involves energetic involvement, continual understanding, and a joint method to trading that makes the most of the potential for success.

Broker Assistance in Market Evaluation

Broker assistance in market analysis extends beyond just technical evaluation; it also incorporates pop over here essential evaluation, view evaluation, and link danger management. By leveraging their expertise and accessibility to a large range of market information and research study tools, brokers can help investors navigate the complexities of the foreign exchange market and make educated choices. Additionally, brokers can provide prompt updates on financial events, geopolitical growths, and various other aspects that may impact money costs, allowing traders to stay in advance of market changes and adjust their trading positions as necessary. Eventually, by utilizing broker support in market analysis, investors can enhance their trading efficiency and enhance their chances of success in the affordable forex market.

Verdict

To conclude, brokers play an essential role in foreign exchange trading by taking care of threats, supplying expertise, and aiding in market evaluation. Choosing the best broker is vital for trading success and leveraging their knowledge can lead to earnings. forex brokers. By making use of danger administration strategies and functioning closely with brokers, investors can browse the complex globe of forex trading with confidence and raise their possibilities of success

Given the critical role brokers play in facilitating accessibility to the foreign exchange market and providing threat administration devices, comprehending efficient techniques for taking care of dangers with brokers is vital for successful foreign exchange trading.Choosing the appropriate broker is paramount for attaining success in forex trading, as it can significantly influence the general trading experience and end results. Functioning with a regulated broker provides a layer of safety and security for investors, as it guarantees that the broker runs within set guidelines and requirements, therefore reducing the threat of fraud or negligence.

Leveraging broker competence for profit calls for a critical approach that includes understanding and utilizing the services offered by the broker to basics improve trading outcomes.To effectively exploit on broker competence for profit in forex trading, investors can rely on broker aid in market analysis for notified decision-making and risk mitigation strategies.

Report this page